Vis børsmeldingen

Kitron’s revenue for the third quarter was NOK 1 054 million, an increase of 43

per cent compared to last year. Growth adjusted for currency effects was 35 per

cent.

Profitability expressed as EBIT margin was 8.6 per cent in the third quarter,

compared to 5.4 per cent in the same quarter last year.

The order backlog ended at NOK 1 863 million, an increase of 18 per cent

compared to last year.

Peter Nilsson, Kitron’s CEO, comments:

“The strong performance in the first half of 2020 continues over the rest of the

year.

A 43 per cent growth in the third quarter and revenue over NOK 1 billion is a

record for Kitron.

The third quarter is characterized by exceptional revenues in medical devices.

The remarkable performance of Kitron employees and partners has made this

possible.

Extraordinary operational execution generated a solid EBIT margin of 8.6 per

cent. Earnings per share is more than doubled compared to last year. Once again,

we increase our full year outlook based on strong demand in several sectors.”

Record revenue

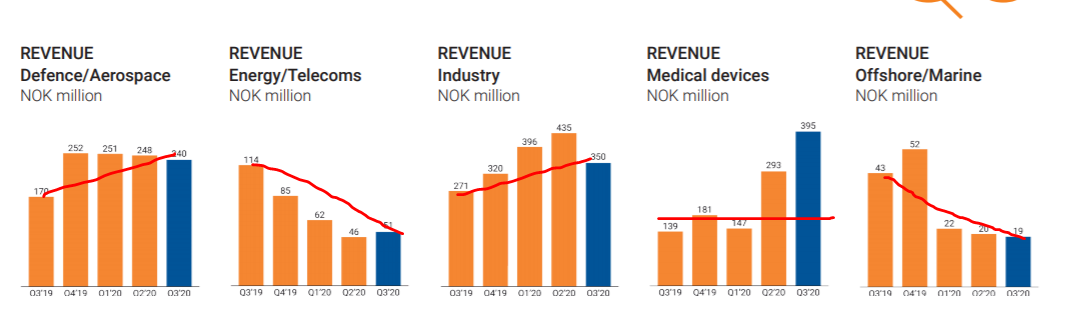

Kitron’s revenue in the third quarter amounted to NOK 1 054 million, compared to

738 million in the same quarter last year. There was strong growth within the

Defence/Aerospace and Industry sectors and very strong growth within the Medical

devices sector.

Strong order backlog

The order backlog ended at NOK 1 863 million, compared to 1 572 million last

year. The order backlog increased within all market sectors except

Offshore/Marine. Growth is particularly strong in the Industry sector

Improved profitability

Third quarter operating profit (EBIT) was NOK 90.5 million, compared to 39.6

million last year. EBITDA was NOK 115.7 million, compared to 59.7 million last

year. Profit after tax amounted to NOK 60.9 million, compared to 24.6 million in

the same quarter the previous year. This corresponds to earnings per share of

NOK 0.34, up from 0.14 last year.

The strong growth has challenged operational cash flow, which ended at negative

NOK 3.2 million, compared to 19.2 million in the third quarter of 2019.

Capital efficiency ratios improved

Net working capital was NOK 1 134 million, an increase of 28 per cent compared

to the same quarter last year. However, capital efficiency ratios improved. Cash

conversion cycle improved from 116 days to 96 days, and net working capital as a

percentage of revenue was 25.1 per cent, compared to 29.5 per cent last year.

Capital ratios are expected to improve further.

Dividend distribution

After the end of the third quarter, and pursuant to the authorisation granted by

the general meeting, the Board of Directors has resolved a dividend of NOK 0.50

per share (see separate stock exchange notice dated 20 October 2020 for further

details).

Outlook

For 2020, Kitron has previously indicated a revenue outlook of between NOK

3 500 and 3 800 million and EBIT margin between 6.7 and 7.5 percent.

Due to increased growth in the Defence/Aerospace, Industry and Medical devices

sectors, overall profitability improvement and favorable currency, revenue is

now expected to be between NOK 3 850 and 4 000 million and EBIT margin is

expected to be between 7.6 and 7.8 per cent.

As previously reported, demand within the Medical devices sector, driven by the

Corona pandemic, has been particularly strong in the second and third quarter.

This is expected to normalize in the fourth quarter and going forward.

Enclosed in PDF are the quarterly report and the presentation. The interim

report is presented today at 8:30 a.m. CEST. The presentation will be given in

English by CEO Peter Nilsson and CFO Cathrin Nylander, and will be webcast at

the following link:

https://channel.royalcast.com/hegnarmedia/#!/hegnarmedia/20201021_1

For further information, please contact:

Peter Nilsson, President and CEO, tel. +47 94 84 08 50

Cathrin Nylander, CFO, tel: +47 900 43 284

E-mail: investorrelations@kitron.com (mailto:investorrelations@kitron.com)

Kitron is a leading Scandinavian electronics manufacturing services company for

the Defence/Aerospace, Energy/Telecoms, Industry, Medical devices and

Offshore/Marine sectors. The company is located in Norway, Sweden, Lithuania,

Germany, Poland, China and the United States. Kitron had revenues of about NOK

3.3 billion in 2019 and has about 1 700 employees. www.kitron.com

(http://www.kitron.com)

This information is subject to the disclosure requirements pursuant to section

5 -12 of the Norwegian Securities Trading Act.

Kilde