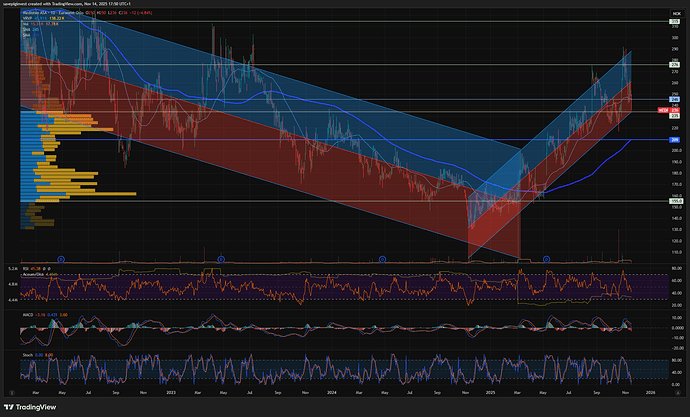

Danske øker kursmål til 260kr.

We expect a solid follow-up to impressive Q1 results

Medistim delivered impressive Q1 results that showed the company’s business areas firing on all cylinders. For Q2, we expect the core ultrasound business to continue to post strong organic growth but expect a more normalised quarter for the third-party distribution business. We are looking for reported group sales growth of 12% y/y (14% organic) and an EBIT margin of 25%.

- Breaking down the expectations. We highlight that it’s especially tricky to estimate Medistim sales on a quarterly basis as the ultrasound business, including consumables sales (aftermarket), is highly dependent on the placement of MiraQ systems in the short term. We expect a total of 58 systems to have been sold in the quarter, up c.14% y/y but down 8% versus Q1. In terms of consumables, we are expecting Medistim to deliver c.12% y/y growth, driven by volumes and mix.

- Third-party sales After a very strong start to the year, where Medistim reported third-party sales growth of 41% y/y, driven by one-off orders to a large hospital in Norway, we expect a more balanced Q2 print with sales growing 3% y/y. Over time, we believe it’s plausible for Medistim to grow its third-party business by mid-single-digits.

- Estimate changes. We make minor estimate changes, mainly due to FX movements.

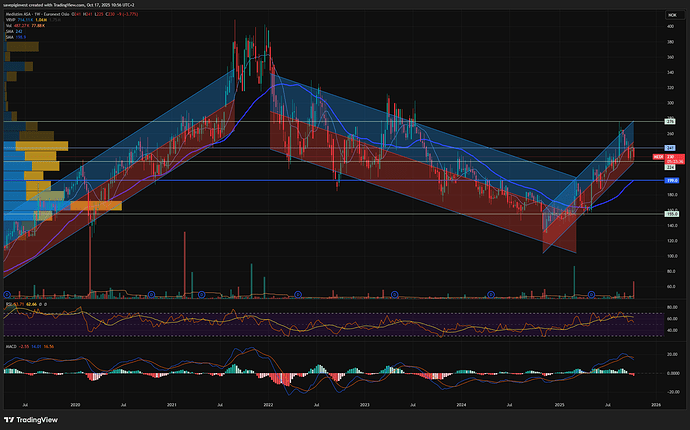

- Valuation. We value Medistim based on multiples. An EV of 24x (previously 23x) 2026E EBIT on our estimates – a 10% discount to its 10-year EV/EBIT average and c.25% discount to peers – yields a 12M target price of NOK260 (NOK250).