Edit: @Christian @Martins se denne

Sprott er ganske tydelig katalysten her, og eneste grunnen til at spotmarkedet beveger seg såpass mye allerede nå.

Er slik jeg forsto den videoen.

Det ville skjedd før eller siden uansett, men spekulasjonen til Sprott har skapt ekstrem fortgang i utviklingen?

Denne er visst ikke postet på tråden enda såvidt jeg kan se:

SPUT/Byron/Dresden add 4% to global demand, PO upped

Uranium (U3O8) purchased by the Sprott Physical Uranium Trust (SPUT) since launching an at-the-market (ATM) equity program on August 17th has added 3% to global demand. This is 52% annualized, or $4bn at flat prices. Prices have risen 42% to $43.75/lb. A supply response is likely but might take time and more SPUT buying is likely, we think. The Illinois House and Senate approved funding to keep the Byron & Dresden nuclear plants from closing. We add both back to our model, increasing annual U3O8 demand by 1.1%. We increase 2021E-2023E U3O8 prices by 18%, 41% and 18% to $36.30, $53.50 and $48.50/b. We raise our price objective (PO) for Cameco (CCO) by 45% to C$36.25/sh ($29/sh), CCO: Neutral as we think outlook is mostly reflected in the shares.

SPUT ATM funding increased to $1.3bn

SPUT has raised roughly $245mn of the $300mn maximum set-out under its ATM program. On Friday, SPUT obtained approval to increase the maximum to $1.3bn. The limiting factor on future SPUT capital raises is market demand for its units, which appears to us to be strong and correlated to SPUT’s ability to continue pushing up uranium prices . Given the relatively small size of the U3O8 spot market (~$2.7bn in 2020, unadjusted for churn), SPUT buying should push spot prices still higher, until supply responds or the price gets high enough to spook investor demand for SPUT units .

So the weakest link in the Sprott strategy is how quickly will incremental supply come on line. The good news for Sprott is that, at least according to BofA, it won’t be for some time.

A supply response is likely but not immediately

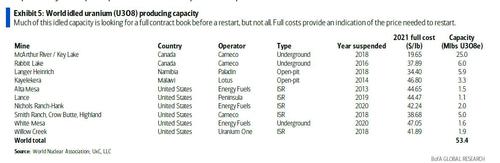

U3O8 held by junior miners and hedge funds, uncommitted supply from producers and a reversal of carry trades are among potential near-term sources of new market supply. Potentially larger sources are 58Mlbs of idled production capacity and 16.8Mlbs of unutilized capacity in Kazakhstan. However, a large majority of this is unlikely to respond without long-term contracts and would require six or more months to ramp-up.

UxC estimates that hedge funds hold around 11Mlbs of U3O8 that was mostly purchased in 2018 and 2019 when prices averaged just $24.61/lb and $25.84/lb vs. the current spot price of $43.75/lb.

There can be many sources of uncommitted supply with BHP’s Olympic Dam (8-10Mlbs annually) and the Navoi mines in Uzbekistan (9Mlbs annually) the usual candidates. Other less obvious sources also exist. For example, we estimate that in H1’21, China imported nearly 21Mlbs of U3O8 which equates to approximately 82% of the country’s 2021E reactor requirements. In addition, Chinese utilities are estimated to hold as high as or more than 460Mlbs of U3O8 inventory, sufficient to cover expected requirements for the next 11 years. As prices rise we see the possibility for some of the U3O8 produced in Chinese owned mines outside of China to be sold into the spot market. We estimate that in H2’21, Chinese owned mines outside of China will produce roughly 8Mlbs of U3O8. We do not expect Chinese inventories to be sold, however. Those are considered strategic.

Kazakhstan under-utilizing capacity: In Kazakhstan, the world’s largest U3O8 producing nation, there are several uranium mines now producing below capacity. On a 100% basis, these mines have a capacity of around 75.4Mlbs but we forecast them producing 58.6Mlbs in 2021E, leaving 16.8Mlbs of additional production potential trough flexing up utilization. However, similar to Cameco, Kazatomprom has indicated it will not flex up its production until they are signing long-term contracts and the price is fair. The latter condition may now be realized, the former remains to be seen. We think KAP sees $40-$45/lb as fair pricing.

Idled capacity is substantial but a majority is disciplined: According to data compiled by the World Nuclear Association (WNA), there is 54.4Mlbs of idled capacity. Cameco, which controls 58% of this idled capacity, has indicated it must fill its contract book at attractive pricing before it will restart McArthur River and has indicated that very high prices would be necessary to restart Rabbit Lake. The price indicated by Cameco for a McArthur restart is $40/lb or greater. Paladin has suggested a similar approach with its Langer Heinrich mine which accounts for another 11% of this idled capacity. Of the remaining 31% of potentially undisciplined producers only 17% (8.9Mlbs) is profitable at the current spot price on a full cost basis. However, much of this potentially undisciplined production will soon be profitable as prices rise.

Det er korrekt. Sprott spiser opp sekundærmarkedet. Og dette er bare starten.

Fordi det tvinger andre aktører (utilities) til å gjøre det samme?

Jeg er inne i et selskap som har mange år frem til produksjon, men funn av høy kvalitet.

Kanskje man heller bør se på selskap med produksjon nærmere i tid for å virkelig ri bølgen… Hmm.

Scroll noen poster opp og se de nposten jeg postet fra reddit. Utilities kjøper ikke enda.

Jeg sitter i ISO. ISO er et exploration selskap. Det har gått ca. 120% de siste tre ukene. Ikke godt å si hvor man bør sitte. Har også URNM.

Jepp, takk.

Fission Uranium e forøvrig selskapet.

Ja, det er vel heller det at utilities til slutt er nødt til å kjøpe, OM prisbevegelsen går langt nok?

Å fy f…

Litt seriøs uran lektyre.

“Uranium stocks and ETFs are surging thanks mainly to rising interest on Reddit’s WallStreetBets forum, well-known for the meme-stock frenzy earlier this year.” Hmmmm, Why Uranium Stocks & ETFs are Going Nuclear

Viktig å spille det ned. Trenger ikke nevne at noen ukjente aktører sendte uran opp 8% igår. ( det var ikke sprott for å si det sånn).

ja, det har sikkert ikke noe med at U prisen ikke har vært så høy som den er nå på mange år…

Ja ser man på…

Noen som benyttet dagens fall til å handle?

Gikk glipp av bunnen fordi jeg var på kino

Tom for FIAT desverre

Flytta det jeg hadde fra $U.UN til $URNM da den falt mye mindre. Traff ikke helt bunnen, men får se til uka om det var lurt eller ikke. Mulig vi skal litt ned på mandag også, for å teste noen støtter. Har litt krutt til gode.

Australia kjøpte opp mye miners etter at USA stengte. Virker som mange ikke ville sitte over helgen og torsdag var frontrunning av det.

Spotprisen lå stille evt steg utifra hvilken børs man ser på. Men vi får se.

Bra med trade! hadde en slik trade i UUN sist helg selv.

Premiums har jo vært på veg ned i $U.UN nå, uten at det har gjort noe stort med kursutviklingen, så blir litt interessant å se hvordan det vil fungere framover. Kan jo hende det renner inn folk til uka som synes den ser mer attraktiv ut da.

Er rabatt på NAV nå. og Sprott har fortsatt penger å handle for. Så de kommer til å fortsette å kjøpe så fort premium på NAV er +1%.