De energiekspertene jeg hører diskutere er i hvertfall ikke enige med deg!

https://www.bloomberg.com/opinion/articles/2022-03-14/ukraine-war-the-oil-price-rally-is-bad-the-diesel-crisis-is-far-worse?sref=5dj0X2VO

https://www.bloomberg.com/opinion/articles/2022-04-13/jet-fuel-sees-crazy-prices-after-two-unloved-years?sref=5dj0X2VO

https://www.bloomberg.com/opinion/articles/2022-05-04/u-s-east-coast-diesel-supply-is-running-on-fumes?sref=5dj0X2VO

https://www.bloomberg.com/opinion/articles/2022-05-09/crude-hovers-at-110-a-barrel-but-the-refinery-margin-makes-us-pay-a-lot-more?sref=5dj0X2VO

The dire diesel supply situation predates the Russian invasion of Ukraine. While global oil demand hasn’t yet reached its pre-pandemic level, global diesel consumption surged to a fresh all-time high in the fourth quarter of 2021. The boom reflects the lopsided Covid economic recovery, with transportation demand spiking to ease supply-chain messes.

European refineries have struggled to match this revival in demand. One key reason is pricey natural gas. Refineries use gas to produce hydrogen, which they then use to remove sulphur from diesel. The spike in gas prices in late 2021 made that process prohibitively expensive, cutting diesel output.

The oil tanks in New York harbor are nearly empty for reasons both global and local. Around the world, diesel is in short supply as demand has surged well above pre-Covid levels, spurred by a boom in freight.

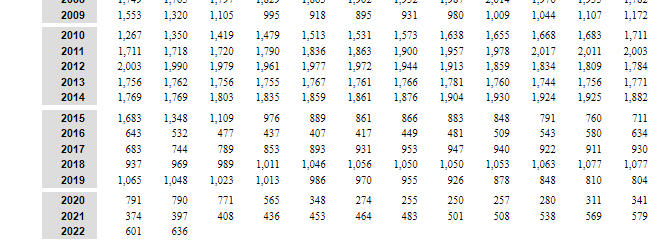

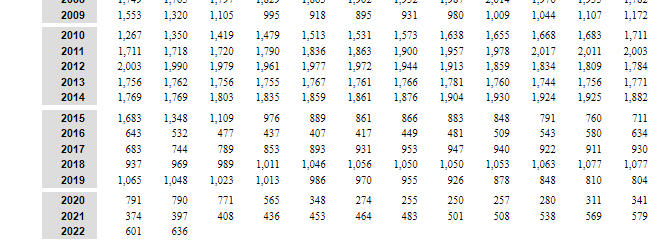

In the past 15 years, the number of refineries on the U.S. East coast has halved to just seven. The closures have reduced the region’s oil processing capacity to just 818,000 barrels per day, down from 1.64 million barrels per day in 2009. Regional oil demand, however, is stronger.

If you are the owner of an oil refinery, then crude is trading happily just a little above $110 a barrel — expensive, but not extortionate. If you aren’t an oil baron, I have bad news: it’s as if oil is trading somewhere between $150 and $275 a barrel.

The oil market is projecting a false sense of stability when it comes to energy inflation. Instead, the real economy is suffering a much stronger price shock than it appears, because fuel prices are rising much faster than crude, and that matters for monetary policy.

The surge in consumption has reduced U.S. jet-fuel stockpiles to the lowest for this time of the year since 2005, according to government data. The situation is worse on the east coast, home to key airport hubs such as Hartsfield–Jackson Atlanta International and Charlotte Douglas International, where stocks have plunged to a 25-year seasonal low.

There are four main reasons behind the explosion in refining margins.

-

First, demand — particularly for diesel — has rebounded strongly, depleting global inventories. In some markets, like the U.S. East Coast, diesel stocks have fallen to a 30-year low. Despite rising prices and fears of an economic slowdown later this year, oil executive say they see strong consumption for now. “Demand is not that easily destroyed,” Shell Plc Chief Executive Officer Ben van Beurden told investors last week.

-

Second, the U.S. and its allies have tapped their strategic petroleum reserves to cap the rally in oil prices. That has provided extra crude, which has put a lid on WTI prices, but it hasn’t addressed the tightness in refined products. Only a small fraction of the emergency release is in the form of refined products, and only in Europe.

-

Third, and perhaps most importantly, refining capacity has declined where it matters for the market now, and the plants that are operating are struggling to process enough crude to satisfy the demand for fuel. Martijn Rats, an oil analyst at Morgan Stanley, estimates that outside China and the Middle East, oil distillation capacity fell by 1.9 million barrels a day from the end of 2019 to today — that’s the largest decline in 30 years.

The downward trend started well before the pandemic hit, as old Western refineries struggled to compete, environmental regulations increased costs and the unfounded fear of peak oil demand amid the energy transition prompted some companies to close plants. The fuel-demand collapse triggered by Covid-19 only turbo-charged the trend, resulting in dozens of refinery operations shutting down for good in Europe and the U.S. in 2020 and 2021. New capacity has emerged in China. However, Beijing tightly controls how much fuel its refiners can export so that capacity is effectively out of reach of the global market.

“Has the oil market hit the refinery wall?,” Rats asked in a note to clients last week. “Unusually, the answer appears to be yes.”

- Fourth, are the sanctions and unilateral embargos — also known as self-sanctions — on Russian oil. Before the invasion of Ukraine, Russia was a major exporter not just of crude, but also of diesel and semi-processed oil that Western refiners turned into fuel. Europe, in particular, relied on Russian refineries for a significant chunk of its diesel imports. The flow has now dried.

**Europe not only needs to find extra crude to produce the diesel and other fuels it’s not buying from Russia, but, crucially, it needs the refining capacity to do so, too. It’s a double blow. Oil traders estimate that Russia has shut down 1.3 million to 1.5 million barrels a day of refining capacity as result of the self-sanctions. **

Who’s benefiting? The pure-play oil refiners, which are quietly enjoying record-high profit margins. While OPEC and Big Oil get the blame, independent refiners are cashing-in. The sky-high crack margins explains why the share prices of U.S. refining giants Marathon Petroleum Corp. and Valero Energy Corp. have surged to all-time highs. The longer the refiners make super-profits, the harder the energy shock will hit the economy. The only solution is to lower demand. For that, however, a recession will be necessary.

Enkelt å skylde på eksterne faktorer når det ikke er fakta. Her nevnes 4 hovedfaktorer, strukturelle årsaker til hvorfor vi er i den krisen vi er i.

Russland er 1, og fremheves ikke engang som den viktigste for refiner margins!

Aktive rigger i US: