Historien har jo en tendens til å gjenta seg selv. To ganger tidligere er rentene satt til null i USA:

Twice in this century, the US went through debt crises so severe that the Fed had to drop rates to zero and resort to unconventional policies like quantitative easing.

The first time was in the 1930s and then again in 2008–2009. In both cases, it “worked” in the sense that asset prices recovered. But it also had adverse side effects.

Unintended Consequences

Higher asset prices benefit asset owners. And most people are not asset owners.

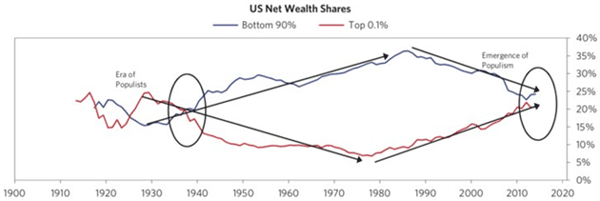

The result is a wealth gap between rich and poor, which of course always exists. But in these periods it grew too obvious to deny.

A small part of society prospers as its assets gain value while the majority struggles. It happened in the Great Depression, and we saw it again in the post-Great Recession years. Data-driven Dalio quantifies it in this chart.

Source: Ray Dalio

Source: Ray Dalio