CALLIDITAS THERAPEUTICS

Volatil handel i Calliditas efter fas 3-data - vd kommenterar (Finwire)

2022-10-20 11:30

Igår föll forskningsbolaget Calliditas aktie 17 procent och idag fortsätter raset efter att ett mäklarhus tolkat fas 3-data för en subgrupp i studien på ett visst sätt. Datan presenterades i förrgår i en peer-reviewed vetenskaplig artikel i Kidney international.

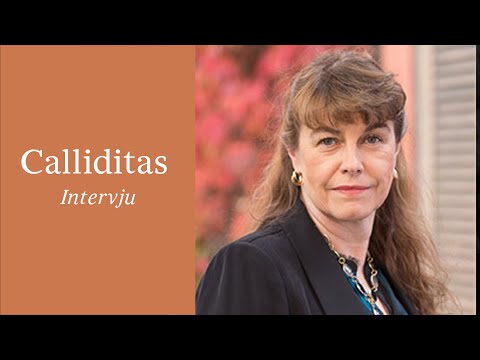

Finwire hörde med Calliditas vd Renée Aguilar Lucander, som gav sin syn på mäklarfirmans kommentar.

“Problemet här är att det dragits slutsatser som inte går att dra baserat på den här datan. Jag har full förståelse för att det är komplext, men då kanske det är bra att få förklaringar på hur det fungerar. Det är ju tråkigt när det blir missförstånd och felaktigheter i sådana här situationer”, säger den verkställande direktören.

Enkelt förklarat gäller det en tolkning av data för en subgrupp med mindre sjuka patienter. Mäklarhuset antyder att Nefecon potentiellt kan ha negativa effekter i denna grupp.

En av huvudförfattarna för publikationen, som har tagit del av mäklarhusets tolkning, menar att tolkningen var “faktamässigt inkorrekt och ett grovt missförstånd av data”, säger Calliditas-chefen.

Aguilar Lucander lyfter även fram att den här datan har varit känd sedan tidigare och att såväl FDA som EMA tagit del av den när de gett sina villkorade godkännanden.

I mäklarhusets kommentar finns även antydningar om att Nefecon skulle utgöra en säkerhetsrisk.

“Det finns en spekulation i den här noten att det skulle finnas några säkerhetsrelaterade problem, men Nefecon har precis gått igenom FDA och det finns absolut inga säkerhetsrelaterade antydningar över huvud taget”, säger hon.

Filip Lindkvist

Nyhetsbyrån Finwire