Every castle needs a moat

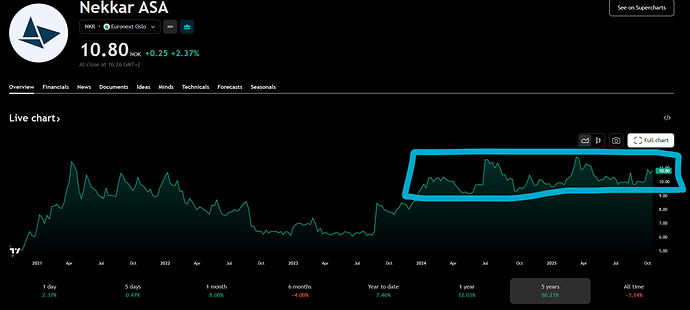

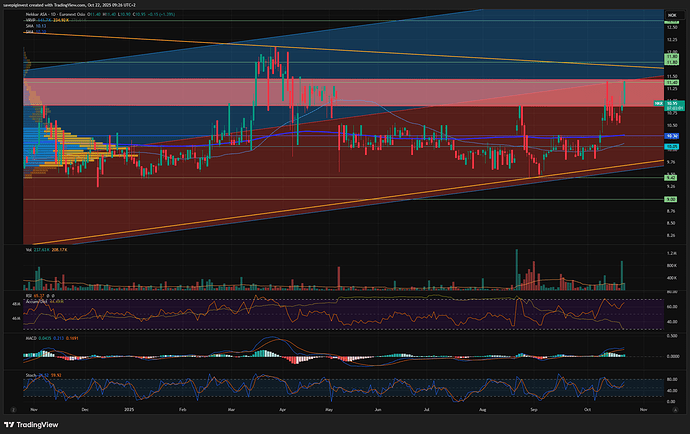

Nekkar invests in and develops ocean-based technology companies, has significant exposure to the defence industry and a net cash position. We point to its significant growth potential, low valuation and prudent M&A strategy. We initiate coverage with a Buy recommendation and 12M target price of NOK18.

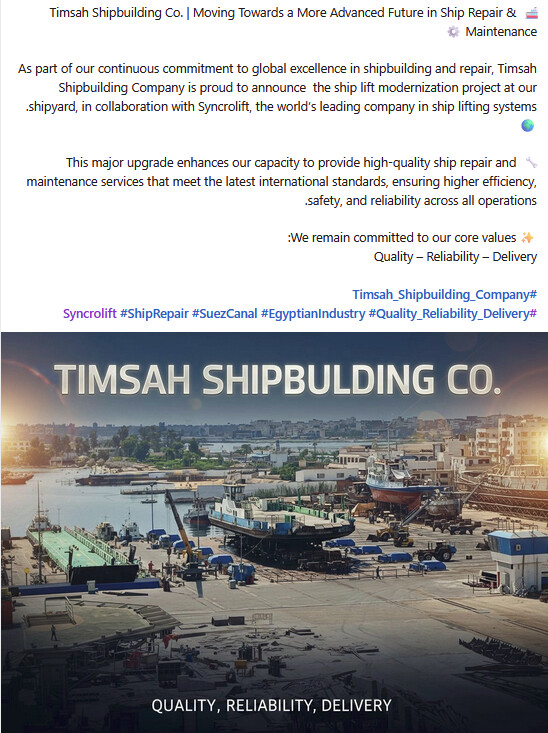

- King of the dock. The largest subsidiary, Syncrolift, designs and delivers shiplifts and yard transfer systems for large vessels. With c.60% market share and a NOK7.4bn tender pipeline (Q2), up c.85% y/y (c.70% defence-weighted), it boasts a positive outlook. For tenders, we model a 35% win rate, translating to c.75% revenue growth to NOK860m by 2027E, with 30% upfront payments and a growing aftermarket underpinning strong cash conversion and visibility.

- Red-light approval unlocks orders. With an option to acquire all of FiiZK, the closed-cage supplier with a strong track record and the largest installed base in this segment globally, we expect a near-term increase in orders as fish farmers use verification-based approval to reinstate biomass lost under the traffic light system. We estimate 3-4% of Norway’s sea volume will be added back in the first phase, with FiiZK positioned to capture a major share of the closed cage orders.

- Robust profitability and growth. We expect Nekkar to reach its 2027 guidance of NOK1.5bn revenue and 10-20% EBITDA margin before M&A. Consequently, we model an FCF (ex. M&A) yield of 12% in 2025E, rising to 18% in 2026-27E.

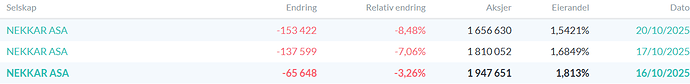

- Valuation. Nekkar trades at 5.5x P/E on our 2027E. As orders start coming in for both Syncrolift and FiiZK, we expect a de-risking to lift the shares. Hence, on our SOTP-based 12M target price of NOK18, Nekkar would trade at 9x 2027E P/E.