Jeg har ikke god nok kunnskap overhodet til å gi noen kalkyler på om potensialet er så og så mange merder, eneste jeg vet er at Mowi er store.

Tar sin det på Tenerife dessverre ja.

However, we were recently informed indirectly and without prior consultation that the Port Authority has shelved our expansion request

Meh

De kunne spart litt ved å gå for det billigere (og bedre?) alternativet på skipsheisen

Nice! Syncrolift har et godt samarbeid med DP World fra tidligere gjennom arbeid på Dubai Maritime City, som det skrytes av støtt og stadig på LinkedIn.

og Cochin har en veldig fin Syncrolift

Minner om denne også om ca 1 times tid (13:10)

https://www.redeye.se/events/1109676/redeye-theme-defence-industry-3

Ole Bull Hansen går på nå.

Edit:

Forventer økte inntekter fra forsvarssegmentet, og at de vil utgjøre en større andel enn i dag (66 %) i tiden fremover. Fikk hauset litt FiiZk helt på tampen: “the most experience, well positioned, ready to take new orders”.

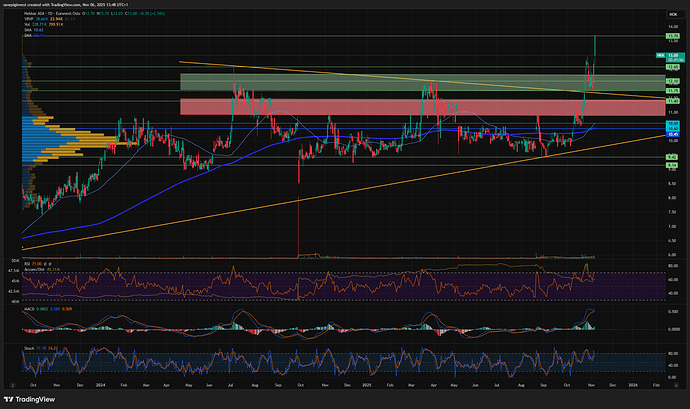

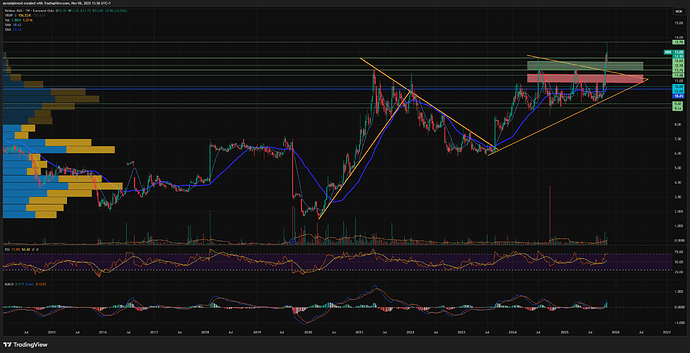

Om den etablerer seg over den grønne boksen her er den latterlig bullish

Bare mer latterlig om man zoomer ut til uke og ser på 11 year high

I chartet mitt fra 2021, så er det reprising

Huske høydesyketabletter for neste år.

Q&A fra Redeye Defence Seminar (oppsummert):

Q: How does Nekkar fit into the ecosystem of defence companies.

A: Syncrolift derives about two-thirds of its revenue from the defence and naval market. With current geopolitical trends, that share is likely to increase over the coming years.

Q: How has the increased defence budgets affected Nekkar.

A: The impact is visible in Syncrolift’s tender pipeline. Important to note that defence projects, especially large infrastructure projects take time. Government decisions on submarines, shipyard capacity, etc., cause a delay before higher defence spending fully translates into new projects. We see it as a tailwind over the coming years.

Q: Consolidation in the defence sector is a big trend, how do you view it in Nekkar?

A: We aim to own and operate niche offshore industries. Having a unique position and key technology is our main goal. If that can be achieved within defence, it’s attractive, but our focus is maintaining a unique position/technology in our markets. That’s how we keep competitive margins and return on invested capital.

Q: Production capacity to meet demand for Syncrolift?

A: Our model is flexible as engineering, project management, and procurement are in-house, while production is outsourced to several suppliers in different regions. We are quite flexible in terms of taking on larger volume.

Q: Could you give us an update on the current commercial development for FiiZk?

A: FiiZk benefits from Norway’s new incentive scheme for closed salmon farming systems, allowing producers to regain lost capacity. With the longest track record and most systems (20) delivered, FiiZk holds a strong market position and is ready for new orders as the scheme gains traction.

Q: Business is booming (in the shiplift market). How do you see competition in Syncrolift?

A: Competition is strong but limited to a few players—mainly US-based firms and some smaller competitors in local markets. “Buy America” creates barriers in the US, but we believe being a Norwegian independent company, also being member of NATO, gives us an edge in all other parts of the world.

Ikke noe som skal ut i offentligheten foreløpig.

Innsyn avslått i følgende dokumenter:

• Dokument

◦ offl. § 12

◦ offl. § 13, 1. ledd, jf. fvl. § 13, 1. ledd nr. 2

Takk for forsøket!

Mowi i trøbbel…

Håper det finnes teknologi i markedet de kan investere i for å bedre omdømmet sitt da