URNM -etf opp over 13%. Få, om noen, andre sektorer er i nærheten av noe slikt.

Noen som har oversikt over spot vs spot i går?

Global Atomic Corp opp over 21% !

Spot råbuller.

Dette er 17 timer siden.

Ja Frankrike har jo skjønt det:

President Emmanuel Macron has said France will invest €1bn in nuclear power by the end of this decade as Europe’s energy crisis spurs renewed interest in the contentious source of power. “The number one objective is to have innovative small-scale nuclear reactors in France by 2030 along with better waste management,” he said while announcing a “France 2030” investment plan on Tuesday.

Og det presser seg fram i EU også…

France also wants nuclear energy to be labelled as “green” in the evolving EU green finance taxonomy that determines which economic activities can benefit from a “sustainable finance” label. France and eastern European capitals want to show investors that nuclear energy is part of the EU’s journey towards carbon neutrality, while Germany and others have resisted, pointing principally to the environmental impact of nuclear waste.

https://www.world-nuclear-news.org/Articles/Ten-EU-nations-call-for-nuclear-s-inclusion-in-tax

Nuclear energy must be included in the framework of the European taxonomy before the end of this year, energy and economy ministers from ten EU member states said in a joint article published in several European newspapers yesterday. The ministers said nuclear energy is “an affordable, stable and independent energy resource”. The Czech Ministry of Energy described the nations as a ‘Nuclear Alliance’.

Fyyy nesten 80mill kan de handle for idag

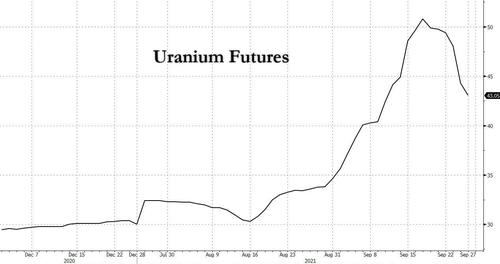

As the FT wrote overnight, after years of stagnant prices, a 37% rally in prices for nuclear fuel uranium has helped attract investors back to the sector. Funds such as Ben Melkman’s New York-based Light Sky Macro, Anchorage Capital and Tribeca Investment Partners who have emerged as positive on the outlook for the raw material, as a global energy crunch highlights the role of nuclear power in a transition away from fossil fuels.

The price of raw uranium rose to its highest level since 2012 at $50 a pound last month before giving up some of its impressive gains at the end of the month.

The move - which was inspired by the buying momentum triggered by the Sprott Trust and subsequent retail influx - has attracted new, and much deeper pocketed investors into the market for the first time since before the financial crisis, when buying by investors drove the price from $20 a pound to a record high of $136 a pound in June 2007.

"We’ve been patiently waiting for something to happen for a long time," Ben Cleary, of Tribeca Investment Partners whose fund is up 345% net of fees this year, told the FT. “ Clearly there’s speculative money coming back into the sector, there were massive price moves in September.”

Well yes, and we documented them all, but they were mostly retail money and ETF buying. The difference this time is that finally the institutions are waking up to what could be a historic surge, especially if the fake ESG lobby starts dumping the bloated FAAMG names and seeks refuge in such “soon to be green” sectors as uranium. Incidentally, the entire Uranium sector is a tiny fraction of Apple’s market cap.

Of course, first and foremost we have to again give props to Sprott’s Physical Uranium Trust - as we have done repeatedly in the past 2 months - which is one of the few that buys and stores physical uranium. however, most other funds add exposure through mining equities, which have rallied 58% this year.

The rapid rise in natural gas and coal prices to fresh highs this month has exacerbated an energy crisis in Europe and China, and has “placed uranium back in the spotlight”, said Rob Crayfourd at CQS New City Investment Managers.

And, echoing what we said a month ago, Crayfourd said that “ the political fallout of this energy crisis will be a greater willingness in the west to extend the life of the existing reactor fleet. It has focused governments on the benefits of secure supply of energy from the nuclear fleet. We expect that to lend support [to prices]. ”

For an example of just that look no further than French President Emmanuel Macron who today said that France would aim to become a leader in green hydrogen by 2030 and build new, smaller nuclear reactors as he unveiled a five-year investment plan on Tuesday aimed at fostering industrial champions and innovation.

While the funds making their way into the uranium sectors are still relatively small, they are hardly inexperienced: Light Sky’s founder Melkman, who was previously a partner at hedge fund Brevan Howard, has gained more than 5% this year, said a person who had seen the numbers.

“Light Sky Macro sees an immediate and sizeable opportunity in the uranium sector, making it one of our highest conviction views for 2021,” he wrote in a note to clients, seen by the Financial Times, earlier this year. A drawdown of inventory during the coronavirus pandemic has compounded tightening supply, while demand is expected to surge in the coming decades, added Melkman, who has been investing in the sector since 2018.

“The growing focus on ‘green energy’ at a political level and the growing demand for [sustainable] assets in the investment community should turn uranium into one of the most asymmetric trades for the coming years, ” he wrote, meaning that the possibility of potential gains far outweighs the risk of losses.

Also profiting is Sean Benson, founder of London-based Tees River. His uranium fund, which buys equity stakes in uranium miners, is up 115% this year.

Benson argued in an investor letter that a deficit of supply relative to demand and a “very supportive” climate change agenda mean that “the current uranium cycle is better than the last on every fundamental metric”. His Critical Resources fund, which invests about one-third of assets in uranium, is up 44% this year.

“A shut down mine, even one that’s been shutdown in good condition, would take 2 years to return to full production. So an immediate move in the uranium price wouldnt lead to an immediate move in supply. Further, when you take uranium out of the uranium mine, by the time you’ve refined the yellowcake to make it into a useable custom fuel for a reactor - takes another year. So if the uranium price was to go to 70, tomorrow, it wouldnt change new mine supply, or at least nuclear fuel rod availability for three years.”

Fra 10:50

Undervurdert kanal. Greit, kanskje ikke “doomsday” temaet som dominerer kanalen er for alle, men det er så mye alpha i disse videoene. Gratis!

DNN kan være i ferd med å bryte horisontal motstand her:

Vær oppmerksom på at de har en at the market aksjeutstedelse pågående nå på 50 MUSD. Samt, alltid gjør din egen DD.

!!! opp 9 Dollar på 24timer…

Det er ganske sykt når prisen var rundt 20dollas for noen måneder siden.

Er det Denison Mines du har mest tro på innen uran? Andre bets?

Ser ut som at URNM kan knekke 100 snart

Jeg har et lite bett på at det kommer et større jump til i prisen idag.

Da knekker den 100.

Du kan kikke på de som inngår i ETF’en URA:

Det er kanskje like greit å handle den hvis du ikke tar deg tid til å gå inn i detaljene. Husk å bruke stop loss, ta tap tidlig, la vinnerne løpe.

Takk. Men hvis uran ventes opp de neste årene, er det ikke da like greit å være long og ikke bry seg for mye om opp og nedturer underveis ?

Alle har forskjellig tidshorisont og risikotoleranse. Hvis du er sitt og hold typen er det trolig best å bruke tid på å sette seg inn i detaljene og velge de selskapene som har høyest kvalitet, samt kanskje krydre med noen up and rising stars hvor mye stemmer. Bare husk at rene exploration selskaper ofte støter på massive problemer, emitterer blåøyet utav aksjene og uran gruver spesifikt tar kanskje 10-15 år å få i drift. Selskaper som har eksisterende drift, brukbare ressurs reserver, heslt noe vekst, ok balanse, etc er derfor å foretrekke. Med URA får du diversifisering, unngår å bli for høyt eksponert mot enkeltselskaper, etc. EFT’er er potensielt farlige instrumenter da utsteder ofte lager syntetiske posisjoner for å styre instrumentet - men det er farligst i råvarer og i derivat markeder, o.l. Antar URA er ok.

Takker. Man kan handle hele ETFen og da redusere risiko betydelig, litt som et fond?

Litt slik. Unngå gearing. Verden er uhyre belånt med mye sentralbank pengetrykking. Det skaper større og større opp og nedturer som ødelegger alle som handler på margin. Skal du sitte langsiktig bruker du ikke margin. Da skal du være proff på Buffett nivå (nesten) - de fleste andre roter det til for seg selv med belåning. Buffett sitter på netto kontanter - ikke lån.